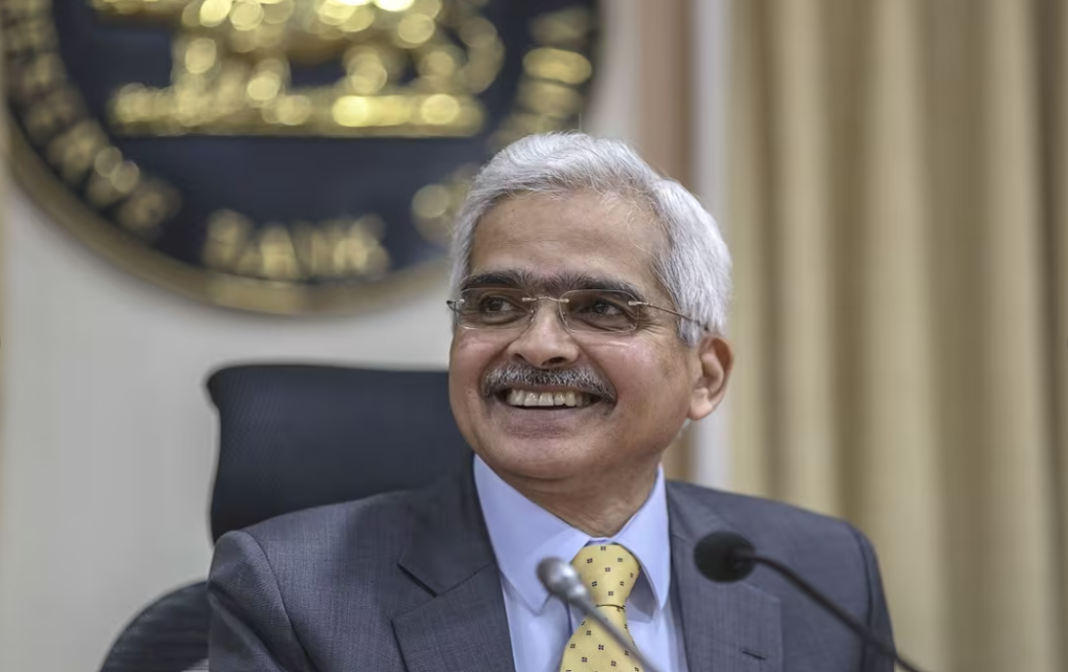

RBI Governor Inflation: During a recent address at Devi Ahilya Vishwavidyalaya in Indore, the Reserve Bank of India’s Governor, Shaktikanta Das, expressed optimism about a potential decline in retail inflation starting from this month. This forecast follows the central government’s measures to stabilize the prices of essential vegetables like tomatoes, limit the export of non-basmati rice, and reduce the costs of household LPG cylinders.

In his speech, Mr. Das highlighted, “Although August’s retail inflation will be significantly high, we anticipate a downturn from September.” He further pointed out the already declining tomato prices and anticipated a similar trend for other vegetables.

Elaborating on the government’s interventions, Mr. Das mentioned measures to ensure the affordable supply of essential commodities for the masses. He said, “The government has recently trimmed down the prices of household LPG cylinders and has placed restrictions on exporting non-basmati rice.”

Government statistics reveal that July experienced a 15-month peak in retail inflation at 7.44%. “The surge in July’s inflation took everyone by surprise. Predominantly due to the skyrocketing prices of tomatoes and other vegetables, this spike was expected,” Mr. Das commented.

Despite the global economic headwinds, the RBI Governor underscored India’s position as one of the world’s fastest-growing major economies. He emphasized the robustness and stability of Indian banks, crediting the rigorous regulatory frameworks. However, he warned, “The domestic financial sphere must always remain alert.” Drawing a comparison, he referenced the recent failures of some banks in the US and major entities like Credit Suisse in Switzerland, praising the fact that such global disturbances didn’t influence India.

In the realm of digital transactions, Mr. Das shared that the Unified Payments Interface (UPI) transactions in India surpassed 10 billion in August. He further discussed initiatives being explored to promote digital payments through feature phones. This is to ensure individuals in remote areas without smartphones or facing connectivity issues can also benefit from digital transaction facilities.

In conclusion, the RBI Governor’s statements reflected a positive economic outlook and emphasized the importance of adapting to the digital era, particularly in the banking and payment sectors.

Read next > Joe Biden to Visit India