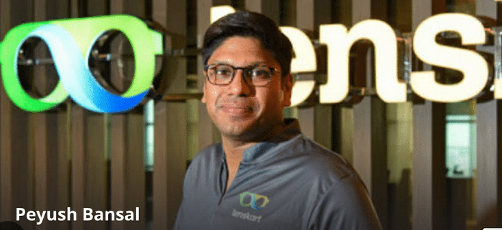

Lenskart, the popular eyewear retail company led by Peyush Bansal, has received a fresh valuation boost from Fidelity, a leading US-based financial services company. As per the latest portfolio update published by Fidelity, the valuation of Lenskart now stands at $6.1 billion, up 21% from the earlier valuation of $5 billion. This increase reflects growing confidence in the company’s future prospects as it prepares to go public.

Why the Valuation Increase Matters

Fidelity’s update is based on data as of April 30, 2025. Crossover funds like Fidelity—who invest in both public and private companies—regularly reassess the value of the businesses in their portfolio. This is done using various indicators such as the company’s financial performance, market trends, investor updates, and comparison with similar companies.

Previously, in November 2024, Fidelity had valued Lenskart at $5.6 billion. The new valuation of $6.1 billion shows a strong upward trend in the company’s market worth and could boost investor confidence ahead of its much-anticipated public offering.

Lenskart’s IPO Plans

Gurugram-based Lenskart is actively preparing for its Initial Public Offering (IPO). According to reports, the company aims to raise $1 billion through the IPO, with a target valuation of $10 billion. This would be double the valuation it commanded during its last funding round.

As part of its IPO preparations, Lenskart has already converted its status from a private limited company to a public limited company. The official name change—from Lenskart Solutions Private Limited to Lenskart Solutions Limited—was approved by shareholders via a special resolution.

The company is now expected to confidentially file its Draft Red Herring Prospectus (DRHP) with India’s market regulator by the end of June 2025.

A Look at Lenskart’s Recent Fundraising History

Lenskart has been on a strong fundraising journey over the past few years:

- June 2024: Lenskart raised $200 million in a secondary share sale at a $5 billion valuation. Major investors included Temasek (Singapore’s sovereign wealth fund) and Fidelity.

- July 2024: Co-founders Peyush Bansal, Neha Bansal, Amit Choudhary, and Sumeet Kapahi invested close to $20 million into the company.

- March 2023: Lenskart raised $600 million from the Abu Dhabi Investment Authority and ChrysCapital. Of this, $450 million was a secondary sale, allowing early investors like SoftBank and Chiratae Ventures to exit partially. This round pegged the company’s valuation at $4.5 billion.

With these investments, Lenskart has raised almost $1 billion in funding, setting a strong foundation for its next big step into the stock market.

Financial Performance: A Move Toward Profitability

Lenskart has also made significant improvements in its financial health. In FY24 (2023–24), the company managed to:

- Reduce its net loss to ₹10 crore, down from ₹64 crore in FY23

- Achieve a 43% increase in operating revenue, reaching ₹5,428 crore

- More than double its EBITDA, which stood at ₹856 crore

These numbers highlight how Lenskart has focused on cost-cutting, efficiency, and tech-driven growth to improve its bottom line. The company credits these gains to its investment in technology and automation.

As of now, FY25 financial results are still awaited and have not been filed with the Registrar of Companies.

Recognition and Expansion Moves

Lenskart’s efforts haven’t gone unnoticed. The company was awarded the Startup of the Year title at The Economic Times Startup Awards 2024. The jury praised Lenskart for successfully building a fast-growing, large-scale, omnichannel retail business, and for creating a new market category in eyewear retail.

On top of its IPO and growth efforts, Lenskart is now reportedly exploring an acquisition of GeoIQ, a startup that specializes in location intelligence. This move could further boost its technological capabilities, particularly in market targeting and store expansion strategies.

What Makes Lenskart Stand Out

Lenskart operates on an omnichannel model—blending online sales with offline stores. This hybrid approach has allowed it to cater to a large and diverse customer base across India and international markets.

The company offers:

- Affordable and stylish eyewear

- Eye check-ups through its stores and home visits

- AR-based virtual try-ons via its app and website

- Fast delivery and easy returns

These customer-centric services have helped Lenskart become one of India’s most trusted eyewear brands.

With a clear path to IPO, a rising valuation, and strong financial performance, Lenskart is set to become one of India’s most high-profile listings in recent years.

If the IPO goes as planned and the company achieves a $10 billion valuation, it could become a major milestone in the Indian startup ecosystem. It would also offer substantial returns to early investors and provide fresh capital to fuel Lenskart’s global ambitions.

Fidelity’s updated valuation of $6.1 billion reflects growing investor confidence in Lenskart. With an IPO in the pipeline, improving financials, and aggressive expansion plans, the company is poised to scale new heights. As India’s startup ecosystem matures, Lenskart is a shining example of how tech, retail, and innovation can come together to build a global brand.