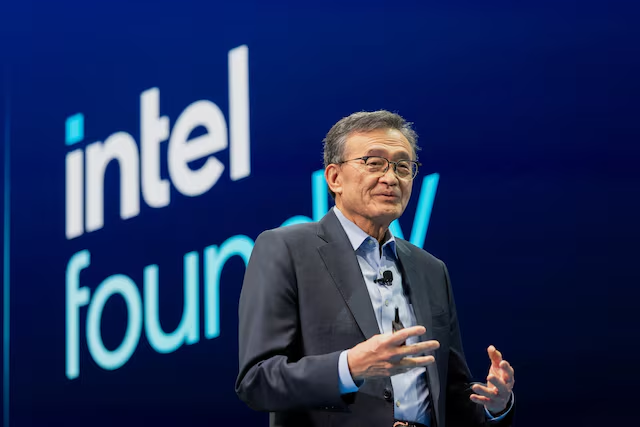

Intel, once a dominant force in global chipmaking, is now undergoing a major transformation. Under the leadership of new CEO Lip-Bu Tan, the company is re-evaluating its multi-billion-dollar 18A chipmaking process—a critical part of its foundry business. This strategic review could reshape the future of Intel’s contract manufacturing operations as it aims to win big clients like Apple and Nvidia and compete more directly with Taiwan Semiconductor Manufacturing Company (TSMC).

Sources familiar with the matter told Reuters that Intel may stop promoting its 18A and 18A-P technologies to external customers, focusing instead on a newer and potentially more competitive process: 14A. While the 18A process was previously positioned as Intel’s technological comeback, Lip-Bu Tan believes the future lies elsewhere.

Let’s take a deeper look at the reasons behind this big shift, what it means for Intel’s future, and how it could impact the global chip industry.

Why Intel’s 18A Strategy Is Being Reconsidered

The 18A chipmaking process was introduced during the tenure of former CEO Pat Gelsinger. It included new transistor designs and energy delivery techniques, with the goal of matching or even surpassing TSMC’s industry-leading chip fabrication technologies.

However, since taking over in March 2025, Lip-Bu Tan has been quickly reviewing Intel’s financial health and production timelines. He reportedly began expressing concerns about the market demand for 18A by June 2025. According to sources, fewer customers are showing interest in adopting 18A, especially with TSMC’s N2 process already on track and its older N3 process delivering in volume since late 2022.

If Intel decides to pull 18A from its marketing plans, it could lead to a massive financial write-off, possibly costing the company hundreds of millions—or even billions—of dollars. This would be a bold, risky move, but one that Lip-Bu Tan appears willing to consider to set the company back on a path to profitability.

Intel’s 2024 Financial Struggles

Intel has faced serious financial difficulties in recent years. In fact, 2024 was the company’s first unprofitable year since 1986, with a net loss of $18.8 billion. These losses underscore the urgency for a turnaround, and the new CEO is wasting no time.

Lip-Bu Tan is working to cut costs, streamline leadership, and eliminate slow, inefficient middle management layers. The reconsideration of the 18A strategy is part of this larger transformation.

The Shift to 14A: Intel’s New Hope

Instead of sticking with 18A, Intel is now preparing to invest more in 14A, its next-generation chipmaking process. According to sources, Tan believes 14A offers a better chance to beat TSMC in terms of performance, power efficiency, and manufacturing capabilities.

Unlike 18A, which struggled to attract external customers, 14A is being designed with big clients in mind. Intel hopes that tailoring the 14A process to meet specific needs of companies like Apple and Nvidia could make it more appealing and competitive in the marketplace.

However, there are risks. The 14A process is still in development, and whether Intel can deliver it on time and at scale remains uncertain. The success of this pivot will depend heavily on Intel’s ability to execute flawlessly over the next year.

The Role of Amazon and Microsoft in Intel’s Plans

Despite the possible shift in strategy, Intel is still committed to fulfilling existing 18A-based contracts. Two of those customers include Amazon and Microsoft, who have already placed chip orders that rely on the 18A process.

The deadlines for these chips are tight, and switching to 14A isn’t feasible for these particular projects. Intel will go ahead with the 18A production as promised, but it may limit further expansion or marketing of the process.

What Intel Has Said Publicly

Intel has refused to confirm or deny these developments, calling them “market speculation” and “hypothetical scenarios.” In a statement, the company said:

“Lip-Bu and the executive team are committed to strengthening our roadmap, building trust with our customers, and improving our financial position for the future. We have identified clear areas of focus and will take actions needed to turn the business around.”

Intel also confirmed it will ramp up production of its “Panther Lake” chips using 18A later in 2025. These chips are meant for Intel’s own laptops and are expected to be some of the most advanced processors ever manufactured in the U.S.

Why Intel’s Foundry Strategy Matters

Intel’s ability to win outside clients is critical to the success of its foundry business. This unit makes chips for external companies, much like TSMC and Samsung Foundry. But in recent years, Intel has struggled to attract and retain big-name customers.

Without competitive technology, Intel’s foundry efforts are unlikely to thrive. That’s why choosing the right manufacturing process—whether 18A or 14A—is so important.

Industry experts say the foundry model needs clear advantages in cost, speed, or customization to convince clients to switch from established players like TSMC. If Intel’s 14A can deliver these benefits, it might finally help the company carve out a significant market share.

The Board’s Upcoming Decision

Lip-Bu Tan has already asked Intel’s team to prepare formal proposals for the board of directors, which will review the 18A issue as early as this month.

However, because of the complexity and financial implications, a final decision may be pushed to the fall of 2025. The board will need to balance the cost of writing off 18A with the potential gains of focusing on 14A.

Until then, Intel will continue its internal production using 18A and keep existing contracts intact, but new client outreach may shift toward 14A.

A Look Ahead: Intel’s Roadmap to Recovery

Lip-Bu Tan is still in the early stages of reshaping Intel. But even now, it’s clear that he is not afraid to make big decisions to turn the company around. His actions so far—streamlining operations, hiring top engineers, and now potentially shifting chip strategies—are a sign of serious intent.

If Intel can successfully transition to 14A and prove it can deliver chips that compete with or exceed TSMC’s technology, it could mark the start of a major comeback.

The next 12 to 18 months will be crucial. Intel must demonstrate to the market that it has the speed, reliability, and technical excellence needed to once again lead the chip industry.

Intel is at a crossroads. With new leadership under Lip-Bu Tan, the company is reconsidering its investment in the 18A chipmaking process to focus instead on the promising 14A technology.

This strategic shift, though risky, could help Intel win back its competitive edge and attract high-profile clients like Apple and Nvidia. While challenges remain, this could be the bold move Intel needs to reclaim its position as a global chip leader.

All eyes are now on Intel’s board as it prepares to make one of the biggest strategic decisions in the company’s history.