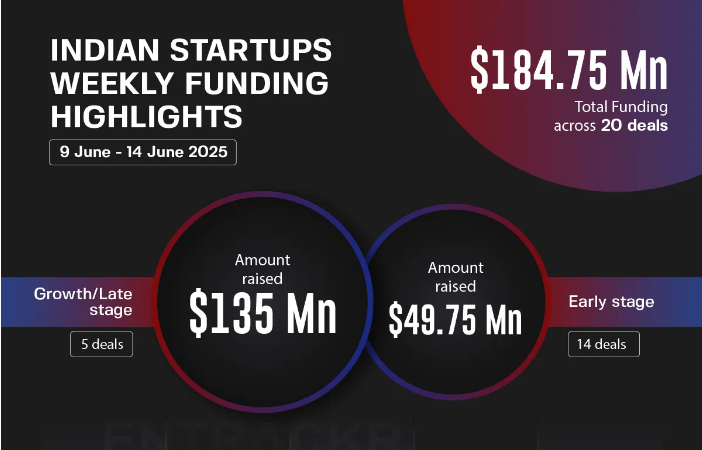

The Indian startup ecosystem continues to thrive as funding and acquisition activities gain momentum week after week. Between June 9 and June 14, 2025, several startups secured significant capital across diverse sectors. This reflects growing investor confidence and signals a strong wave of innovation in the country. During this week, startups raised over $185 million through 20 funding deals. The sectors ranged from fintech, deep tech, and EVs to defense technology, showing a shift from traditional industries to future-focused innovations.

Fintech Gains a Boost Through Mega Deals

One of the most notable events this week was the $72 million Series D funding round raised by CRED, the fintech unicorn led by Kunal Shah. The investment came from top-tier players including Lathe Investment, RTP Global, Sofina Ventures, and QED Innovation Labs. Known for its credit card rewards and financial services, CRED is planning to expand into wealth management and personal loans. This funding round is a clear signal of ongoing investor trust in consumer-centric fintech solutions that simplify money management in India.

IPO Preparations Put Growth in Spotlight

Another major highlight was the $200 million Series F fundraise by Groww, an investment platform popular among millennials and Gen Z. The round was led by GIC and ICONIQ Capital, pushing Groww’s valuation to nearly $7 billion. With an IPO expected in 2026, Groww continues to make stock and mutual fund investing easier for India’s younger population. The capital injection strengthens its position as a major player in the public financial services market.

Credit Access for MSMEs Strengthened

FlexiLoans, a digital lending platform for MSMEs, successfully raised $44 million in Series C funding. This funding is especially vital for Tier II and Tier III cities, where credit access remains a challenge. The company plans to use the capital to upgrade its tech infrastructure and scale outreach to underserved markets. This aligns with India’s broader mission of inclusive financial growth.

Spinny Drives Ahead in Used-Car Segment

In the auto-tech space, Spinny, a leading used-car platform, raised $30 million in an extended Series F round, with support from WestBridge Capital. Spinny is known for its transparent and digital-first car buying experience. The company aims to enhance logistics and customer service, tapping into the steady demand in India’s used car market, which remains resilient even amid economic uncertainty.

Defense-Tech and Deep-Tech Innovations Rise

This week saw a significant push in defense-tech, with Sanlayan Technologies raising ₹186 crore (~$22 million) in a Series A round. Backers include Ashish Kacholia, Jungle Ventures, and Lashit Sanghvi. Sanlayan specializes in smart battlefield technologies, such as surveillance drones and electronic warfare systems. This funding will strengthen R&D and help scale operations to meet India’s growing defense innovation needs.

EV Ecosystem Gets Smarter with Vecmocon

Electric vehicle (EV) deep-tech startup Vecmocon secured $18 million in Series A funding. The company provides AI-powered vehicle intelligence systems for EV manufacturers to monitor battery health, vehicle safety, and performance analytics. Investors like Ecosystem Integrity Fund, Blume Ventures, and Aavishkaar Capital are backing Vecmocon’s vision. This funding will be critical for India’s goal of achieving sustainable mobility through smarter EVs.

Seed-Stage Innovations Show Promise

Several early-stage startups also made waves this week. Pehle Jaisa, an agritech startup, raised $300,000 in a pre-Series A round. It focuses on rural waste-to-fertilizer conversion, a much-needed innovation for rural sustainability. Similarly, Roomstory.ai, an interior-tech platform using AI for smart furniture shopping, raised ₹3 crore in its pre-seed round. Other startups like PowerUp, Zype, and FlickTV attracted investor interest. These seed-stage deals prove that the ecosystem continues to support bold ideas from the ground up.

Strategic Acquisitions Enter OTT Arena

The media and entertainment sector also saw movement, with Zee Entertainment acquiring a minority stake in Bullet, a rising OTT platform offering short-form regional content. Although the amount was not disclosed, the acquisition is seen as a strategy to target Gen Z and regional digital audiences. This move indicates the growing competition in the OTT space as media giants aim to diversify content offerings.

Regulatory Changes and VC Momentum

The Indian startup ecosystem also saw a major regulatory boost this week. The government’s clarification on SCRA rules now allows stockbrokers to invest their own capital in startups. This was welcomed by Nithin Kamath, founder of Zerodha, as it directly benefits Rainmatter, Zerodha’s startup investment arm. In addition, Swishin Ventures launched a $20 million VC fund dedicated to supporting Tier II and Tier III city entrepreneurs. These developments aim to decentralize innovation and give a boost to non-metro startup founders.

The period between June 9 and June 14, 2025, showcased the vibrant health of India’s startup landscape. A total of 20 startups raised $185 million, touching sectors like fintech, defense, EVs, media, and agritech. These developments highlight the diversity of innovation, the depth of investor interest, and the regulatory support that’s helping the ecosystem flourish.

From multi-million dollar unicorn rounds to seed-stage rural innovation, India’s entrepreneurial spirit is proving to be resilient, inclusive, and globally competitive. As more startups emerge from beyond the metros, and policies evolve to support them, India continues its journey as one of the most dynamic startup hubs in the world.